Each year, executives approve multimillion-dollar budgets for capital projects on the strength of a couple of half-hour boardroom presentations. Often, the only assurance executives have that the project scope is sound is the persuasiveness of a fancy PowerPoint deck and earnest presenters.

How can executives have confidence through the entire project lifecycle when they have only scratched the surface of a project's projected potential?

To ensure they have the best chance of delivering on their strategic objectives, large capital projects should go through a rigorous, structured capital project approval process. A development lifecycle is put in place to test cost assumptions with project budgets, risk assessments and market condition evaluations to ensure the project planning and capital project are fit for purpose. This is often called Front End Loading (FEL).

In an ideal world, large projects go through a multitude of checks and balances that carefully build the business case for all capital project proposals.

Some will go through up to four capital project approval gates – each one narrowing the range of accuracy around total project budget, investigating risks, and considering project design options until the team is confident about its figures and solution before they seek to obtain approval.

Such processes are worthwhile investing effort in given that IPA research (Interpretative Phenomenological Analysis) shows that FEL is one of the most significant drivers of project success.

This type of detailed development lifecycle and project planning is what executives assume has happened before they commit to pressing the green light and approving the capital budget at the end of the boardroom presentation. But it's an assumption that needs to be tested before capital project approval.

In some organisations, project managers who may be overworked and under pressure take shortcuts with project planning in the development phase. When this happens, projects that were thought to cost $50 million suddenly balloon out as they progress.

The wrong technologies are adopted because of insufficient due diligence. Some approved projects turn out to be impossible to build – irrelevant of the total project cost. Or the approach isn't fit for purpose. And sometimes a capital project will be built, only to fail to solve the business objective that got its approval over the line, because the market has evaporated.

How can executives ensure the business case they are presented with is sufficiently robust?

Make the capital project approval process transparent

Organisations need a fast, easy means of tracking and validating all the steps that go into capital planning. Ideally, this should be visualised on an executive dashboard, allowing teams to drill down into each step to check risk, cost, technology, and market assessments before seeking project approval.

“When you can adequately assess a project's viability from all angles, you are closer to achieving successful project outcomes and having confidence in your capital planning.”

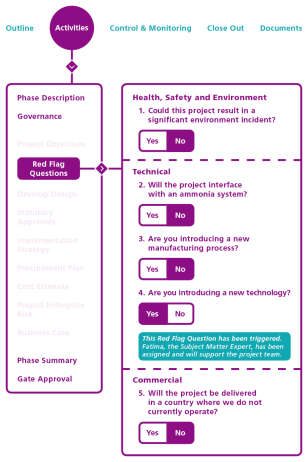

By guiding project managers through the project development process, you can record assessment answers at each stage. The process gathers information on both project and enterprise risk and records whether the project has been subject to ‘red flag questions'.

In fact, for many smaller (sometimes essential or urgent) projects, the site engineers are best placed to identify and manage the work.

However, those individuals are not exposed to capital project delivery often, so hunting down the right tools and guidance can be time-consuming, and what might seem like a simple process to someone inside business processes every day can generate the potential for missed steps.

Executives can examine the scope of the capital project, project budget, and its timeline. And equally, understand its sequence in the capital project portfolio.

Project managers are able to assess the level of definition and risk remaining in the project, which allows them to assign an appropriate contingency budget to accommodate that risk.

CAPEXinsights makes any shortcuts the business takes transparent by showing why decisions were made at each development stage – giving executives confidence the project on the table is accurately costed, properly risk-assessed, and aligned with corporate objectives.

For more information on how CAPEXinsights can simplify your business processes and help you achieve your capital project and portfolio potential, please don’t hesitate to reach out to us.