Case Study: Navigating capital project portfolio challenges in the Fast-Moving Consumer Goods industry.

A case study

“This tool makes risk management easy so that it can be tracked by anyone any time. I just recommended this software.” - Portfolio Manager

For this long-established fast-moving consumer goods provider with hundreds of brands under their global umbrella, making impactful business decisions for the planet was part of its ethos. This included the decisions they made in their capital project portfolio, and yet challenges often arose as a result of maintaining consistent operations through supply chain volatility, adapting to diverse and emerging needs of consumers, or simply reprioritising to sustain growth.

With a 400-strong network of manufacturing sites to produce and distribute goods to customers in more than 190 countries, capital projects are a fundamental part of their operational and strategic efficiency.

Demand across global markets is always evolving, so improved manufacturing agility is essential to keep pace, placing greater importance than ever on effective capital project portfolio management.

Shifting capital investment strategies, including a renewed focus on sustainability, meant an increase in capital expenditure with an uptick in small capital projects. But this came with a multitude of challenges.

Some of the issues were:

- Small capital projects were burdened with too much process, slowing down project delivery.

- Difficult approvals process through a SharePoint site and Excel spreadsheets.

- Increasing appetite to introduce mandatory business processes for consistent governance.

- Existing risk management processes were left to interpretation from a PDF manual, making it either onerous relative to the complexity of the project or not robust enough.

- Little transparency over managing the global capital project portfolio.

The business grappled with managing smaller projects within established project lifecycle guidelines. Existing processes were proving unnecessarily onerous, which resulted in selective adoption and wide variability in delivery.

Many thousands of projects delivered annually were liable to subjective interpretation of processes, especially for small projects that are often run by site managers or inexperienced project managers. Subsequently, risk management processes and sustainability decisions weren't governed adequately.

Another challenge came from communicating process requirements, organisational strategic objectives, and sustainability priorities at the site level. When flawed projects were green-lit too quickly, only to be abandoned at a later stage due to risk or de-prioritisation, it wasted capital expenditure that could have been better prioritised.

Due to a lack of prioritisation, deviations from strategy couldn’t be easily realised from multiple spreadsheets, making dynamic portfolio management difficult. Portfolio managers already found progress reporting time-consuming and manual so increased frequency in collating reports wasn't the answer.

The trickle-down effect of these issues equaled a compelling need to integrate systems, update processes and bring their people together for a united approach.

Balancing geographic and project diversity in the capital portfolio

The driving force for change wasn’t simply to source better project lifecycle guidance and risk management solutions but to bring a level of transparency to their capital project portfolio management in order to make greater strategic investment decisions.

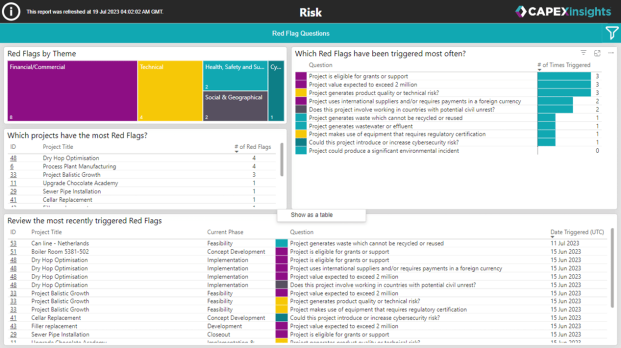

Often the bigger the organisation, the greater the need for project portfolio consolidation. Identifying and mitigating risks early in the project lifecycle meant that top-down guidance could be applied and better project delivery outcomes could be achieved. Especially for small projects that still needed the right risk assessment but with a smaller project lifecycle.

Embedding their risk management processes into the project lifecycle gave confidence that their project teams were being effectively compliant, no matter the size of the project.

The significant consequences of not solving these challenges were being felt across the business - unwelcome delays in getting products to market, cost overruns, unforeseen environmental impacts, and potential operational risks. The engineering, portfolio, and finance teams could see the benefit of mandatory business processes that global teams could easily adopt.

Safeguarding through intuitive portfolio management.

A key requisite was to institute consistent processes before implementing a system to manage their diverse portfolio of projects.

It was important that they partner with a solution that understood the complexities and nuances of varying processes. Given their focus on global consistency, a best-practice risk management governance approach that eliminated manual reliance would be necessary.

The global nature of the business and the need to connect the right people at the right time meant an increase in feasibility and development phases of projects.

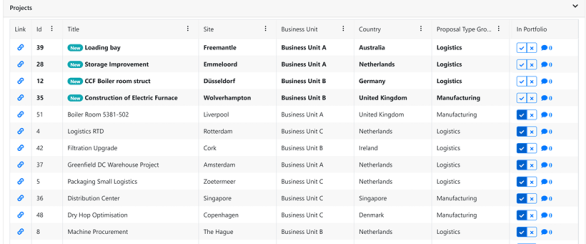

CAPEXinsights enabled this cross-functional collaboration across regions and projects, with mitigation triggers and approval processes tailored to the organisation. It was now easy to access information for review enabling real-time reporting and compounding benefits across teams.

Like many organisations with a firm focus on sustainability, capturing ecological impact in the capital project portfolio was a huge benefit. The Sustainability Calculator captured relevant sustainability information without the added burden of yet another stand-alone system.

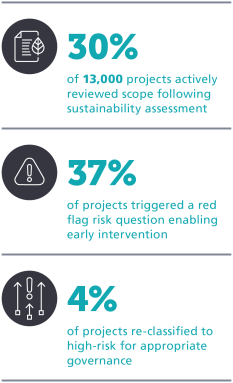

To date, more than 13,000 projects have been assessed using the sustainability impact assessment, with almost 4,000 activating a trigger that highlighted projects with a significantly increased or reduced sustainability outcome.

These triggers were critical in understanding what changes needed to happen before the project impacts were realised over time. These impacts were aggregated in the portfolio to easily support and report on their sustainability progress.

A powerful repository for capital investment resilience.

“Great for pre-capex review. Easy to use with useful information.” – Project Manager

For this multi-national powerhouse, their capital project portfolio management system needed to strike the right balance:

- Connecting the right people

- Guiding risk mitigation measures

- Applying the right processes for the size and complexity of each project lifecycle

- Investing in the right projects to deliver more sustainable outcomes.

- Aligning the project portfolio to organisational strategy.

They achieved all of this and more. Leaders can now provide valuable and consistent results with greater clarity. Project portfolio teams have complete visibility enabling a greater understanding of what’s needed for success, and the ability to intervene early for corrective action and a reduction in inefficient investment decisions.

For more information on how CAPEXinsights can transform your capital portfolio management, just like this customer, please don’t hesitate to reach out to us.