For every capital project, variance is a lead indicator of success. But at a portfolio level, whether projects come in on budget or not is just one element of financial success. In order to optimise resources - which typically leads to a higher Return on Investment Capital (ROIC) - portfolios need to achieve predictable outcomes.

And the most reliable way to do this is to spend as per plan. So even when a project is on track to be successfully delivered with little or no variance, if the project is delayed and spending is pushed into a future year, it can significantly impact the current year's portfolio plan.

“Shareholders use the capital portfolio to evaluate the strategic alignment of an organisation. Even when there is no variance and project spend is delayed from one financial year to the next it can significantly erode shareholder confidence because, from their perspective, the portfolio is underspending based on financial planning and not achieving its proposed objectives”

If project spending is delayed or expenses pushed out, it can indicate to investors the portfolio plan isn’t progressing as agreed toward its objectives. Equally, if project spending remains within the forecast financial year and plans to deliver in Q2 or Q3 are pushed out to the final quarter, the capital expenditures in Q4 create a significant burden on project delivery teams and can impact an organisation’s cash flow.

Conversely, the ideal situation is for the project portfolio to spend consistent project costs each month. Staying on top of that comes down to understanding and being able to effectively track variation in cash flow.

Variance vs variation in cash flows

While variance measures the difference between the budget and the estimated final cost, variation measures the difference between the actual spend curve and what was agreed at a particular point in time, for example, when the cash flow was approved at the CapEx gate.

Both perspectives are critical for both Portfolio Managers and Finance Business Partners to understand and measure financial performance.

Being able to quantify variance is important to establish how well a project is being financially managed. Variance is typically divided into ‘good’ (under budget) and ‘bad’ (over budget), but the line is not as clear cut as that, given that some overspend is permissible under certain capital governance policies.

Certain underspend may indicate project scope has been inaccurate or portfolio cash flow analysis hasn't been undertaken. Overall, project variance is relatively simple to understand with operating expenses and cash flow data.

Measuring variation, however, is about articulating incremental progress in real-time to spot deviation early enough to rectify, re-forecast, or adjust resourcing. Variation requires a line in the sand to measure against - which is the initial forecasted project portfolio plan.

When to measure baseline cash flow in your project portfolio

Cash flow variation is measured from a baseline.

While measured at a project level, the power of baselines actually comes from understanding and analysing cash flow variation from within a portfolio lens.

There are numerous key points in the project lifecycle where baseline measurement can be particularly effective:

- When the project is endorsed to be part of the portfolio.

- Development gates.

- CapEx gate.

- When there is a significant change in the project during implementation – for example, such as an overspend approval, or a significant project scope change.

In our experience, we generally recommend that organisations first focus on the CapEx gate.

Creating a baseline cost amount at this point in the project lifecycle is the most recognisable and logical point for a project team to determine a calculated ‘promise’ to the business about the spend forecast.

The various ways of capturing cash flow variation

Most organisations run their capital project portfolio off spreadsheets where simply getting monthly or quarterly cash flow statements is a challenge - let alone measuring the variation from the agreed baseline. Portfolio and Project Managers are running blind with respect to the agreed spend curve leaving little transparency over project management and capital portfolio cash flow.

This doesn't need to be though as we support cash flow baselining functionality to manage a company's capital expenditure cash flow. Within CAPEXinsights, there are numerous ways to categorise investments and analyse baseline cash flow variation.

Organisations find it most helpful to classify cash flow baselining in the following way at a project level:

- No variation - this indicates the project is spending the forecasted payment milestones each month that was predicted when it passed the CapEx gate.

- Negative variation - here the project spend has fallen behind the baseline cost, and by consequence, spend will be deferred to future months.

- Positive variation - this is where a project manager is spending more money than predicted and will spend the budget sooner than forecast.

At a portfolio level, as long as projects are spending within a financial year, there are sufficient 'overs' and 'unders' for about 70% of the portfolio where variation won't critically impact.

Often variation is secondary to concerns about variance in Q2 and Q3. However, if there is too much negative variation, cash flow is heavily weighted towards the end of the year in Q4 when understanding variation becomes crucial to achieving the portfolio plan.

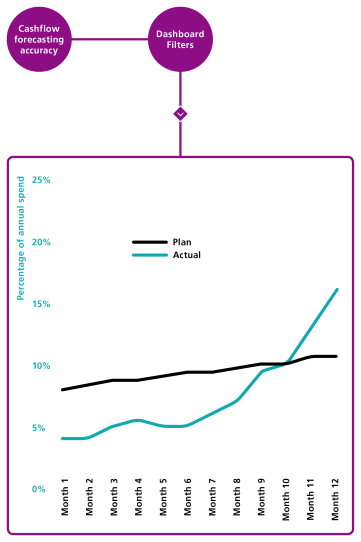

Avoid the dreaded hockey stick cash flow curve

To achieve project portfolio utopia, project management teams need to spend in line with what was agreed upon.

And Portfolio Managers need the power to schedule projects so that there’s enough cash flow at the start of the business year (typically from carry-over projects), and not too much money left unaccounted for in financial statements at the end of the year (when things get challenging).

When an organisation is resource-constrained - and most are nowadays - it’s not possible to ramp up project delivery to such an extent that the balance of the portfolio plan can be delivered in Q4 alone. This leads to unplanned carry-over investments in Q1 of the following year and under-delivery of assets in the current year’s portfolio plan.

While carry-over projects in the following year might be welcome to smooth the overall cash flow, it doesn’t help with achieving this year’s capital portfolio objectives or delivering capital assets that support the growth rate of the company.

For further information about cash flow baselining or to have a personalised demonstration of our product, please don’t hesitate to reach out to us.