Most organisations spend between 2% and 10% of overall revenue on capital projects – a huge investment that is rarely seen on the balance sheet because capital projects are owned by business units and never aggregated in their own right. If we don’t have transparency, how do we apply the right level of governance and process to achieve a successful project?

It's challenging for many executives to grasp how the capital funds they are approving will actually be spent. In effect, some leadership teams approve a capital portfolio budget, rather than a portfolio of capital projects. Often, capital project planning and total project cost are justified by a single line item in Excel, for example: “$5M warehouse”.

Capital projects are a critical means of translating corporate strategy into action. Individuals responsible translate their strategic planning priorities into top-down guidance for resource funding, for example: 10% for sustainability projects, 30% for compliance, 50% for cost reduction projects, and 10% for growth projects.

This top-down guidance is critically important, but it doesn't go far enough. It's difficult for portfolio approvers to have a comprehensive understanding of the project proposals under consideration – and subsequently rare to see organisations with consistent governance mechanisms they use to choose, develop, track, and resource investments at the corporate level.

As a result, capital project management and portfolio development remain largely invisible to an executive audience – leading to cost wastage, poor capital investment returns and missed market opportunities. Especially for major projects where project success and project completion are paramount to achieving organisational strategy.

Improve top-down guidance in capital projects

How do executives know those projects are delivering strategic growth, rather than value destroying growth?

Is the capital project planning approach consistent with the company's strategic priorities – and balanced according to key criteria? Is it focusing too much on “me too” rather than “disruptive” products? Is it favouring tactical investments with short pay-back times rather than supporting the higher-risk investments with longer pay-back times critical to supporting future growth? Or are you over-investing in proposed projects relative to your installed asset base?

Executives who don't know the answers to these questions should be providing more targeted top-down guidance to capital project planning by going beyond the broad-brush percentages and providing specific and well-communicated guidance relevant to each portfolio manager.

Evaluate projects using a centralised project management platform

Businesses proposing capital projects need clear strategic priorities translated into specific capital project investment guidelines and budgets. Capital project planning must be evaluated comprehensively against these guidelines to adequately identify project scope, project schedule, resources required, and project success measures.

The only way to lay the foundations for this critical path is to stop relying on spreadsheets for capital project planning. Not only are spreadsheets unwieldy, they are prone to human error and interpretation issues and often contain data that is out of date. Research shows that 90% of spreadsheets contain errors.

"Spreadsheets make it very difficult to combine new and carry over projects during portfolio build. This is highly problematic given carry over projects can represent up to 40% of a portfolio."

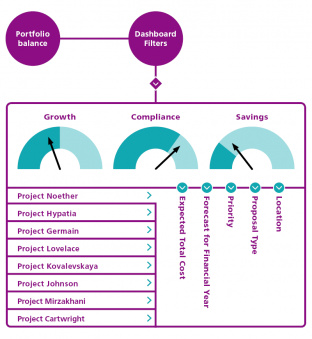

To make project evaluation fast and simple, industry leaders need cloud-based business intelligence platforms that can capture and visualise project “scores” on a dashboard.

Dynamically, project teams can assess the attractiveness of a project using a common framework, including strategic alignment during the planning process.

The outcome of the assessment is a numerical score. The higher the score, the higher the attractiveness for project prioritisation.

This score becomes another tool to help portfolio managers create the initial portfolio build, which should then be reviewed by executives and assessed against revised top-down guidance, depending on changing market conditions, before being finalised.

Use dynamic resource allocation to smooth cashflow

Most capital project portfolios are managed according to the myth that projects start on the first day of the financial year and achieve project completion on the last day. We see the consequences of this at year end when projects get pushed up against the fictitious financial year deadlines, leading to unintended project management consequences.

Project managers have been known to pay to airfreight equipment in so they can meet capital project planning objectives and achieve capital spend within the financial year! (The infamous hockey stick.)

In an ideal world, capital project planning should include staggering projects throughout the year, starting and stopping strategically to smooth cashflow and remain aligned to changing strategic priorities. In this world, carry over projects would be seen as less of an issue and more of an opportunity to continue to shape the capital project portfolio to meet strategic objectives.

This type of ongoing dynamic resource allocation makes it substantially easier to manage project planning and operating cost. It means portfolio managers can review projects with a focus on prioritisation, risk and use resources across financial years.

Dashboards help inform ongoing decision-making with real-time information to maintain the strategic intent of the portfolio, sustain ongoing capital project planning and enable periodic portfolio health checks.

When assessing portfolio build, the platform makes it easy to see what carry-over projects are in play, when they're likely to finish and what that will do to cash flow. Then new projects can be positioned around these existing constraints, with portfolio managers able to manipulate different build scenarios to create the best strategic and cash flow outcomes.

When executives and portfolio managers have a means of evaluating, tracking and controlling capital project planning, the annual portfolio build process becomes substantially more efficient. The result is a smart, strategic portfolio of capital projects that create both strategic and financial value.

For further information about capital project planning or to have a personalised demonstration of our product, please don’t hesitate to reach out to us.