Every organisation makes critical investment decisions based on the information they have available at the time. Besides time-traveling into the future, it’s hard to be certain if you’re spending money efficiently.

Achieving the best possible capital project portfolio results relies on an ongoing intimate understanding of the portfolio’s current state and accurate forecasting. Unfortunately, getting a clear picture of either - not to mention both - can be remarkably difficult.

A huge challenge for many organisations is when a capital project portfolio underspends their capital expenditure for the year. Through the work we do with large organisations, we typically see annual spend of only 70-80% of the forecast budget, which leaves a significant portion of shareholder investment not delivering a return or contributing to the organisation’s strategic objectives.

This obviously has ramifications for future investment but also stunts growth in the short term.

Resource availability in the project portfolio will always be subject to change depending on project performance, potential risks, or even a change in strategic planning. It's essential to require ongoing project portfolio analysis to adequately forecast project portfolio outcomes and ensure resource usage.

With early intervention, some of the issues that drive this type of underspend - such as hockey stick spending that jams unachievable workloads into the back half of the financial year - can be rectified before it negatively impacts the long-term value of the portfolio.

The answer to improving your capital expenditure strategy and project portfolio management lies in eliminating financial ambiguity.

“Understanding the portfolio current state clearly and fully from both a financial and performance perspective is crucial. But the real value lies in being able to stand at that point armed with information so you can confidently rely on your forecasts moving forward.”

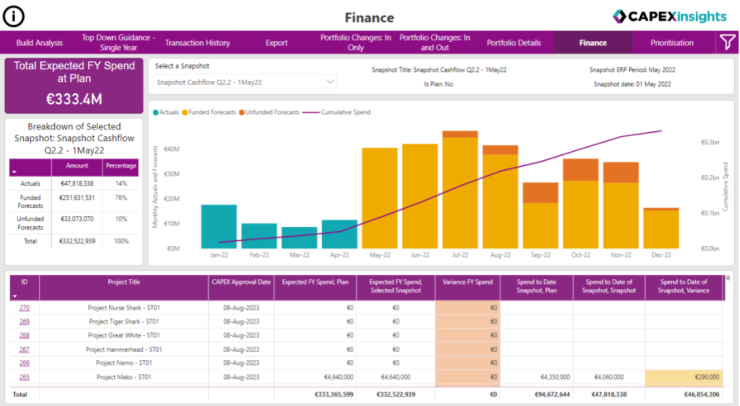

The forecasting process relies on data collection from project estimates, actual project costs already incurred, and project duration to calculate resource utilisation for the remainder of the portfolio. This "snapshot" can be modeled including different projects within the portfolio to compare resource allocation based on business drivers.

Avoid underspend with big-picture portfolio management

Managing capital expenditure successfully relies on three key elements:

- Comparison: Understanding how the portfolio is tracking within the context of the resource plan is powerful, especially in quarterly reviews that require teams to measure progress. Comparing current position with future state projections provides a strong foundation for critical decision-making and avoiding hockey stick spending.

- Confidence: Differentiating between funded and unfunded forecasts, is crucial to establish confidence in the outlook of available resources and key benefits achieved. Without that level of breakdown, it is difficult to understand the extent to which you can trust the projected numbers and effectively manage resources.

- Identification: Seeing which individual projects are having the biggest impact on the portfolio’s underspend is important to re-focus resources and make decisions early enough on project substitution or acceleration. Complex projects often require project forecasting across multiple portfolios based on project scope, capacity planning, and risk management processes required.

The Portfolio Snapshot tool in CAPEXinsights was designed to spotlight these three key elements by overlaying real-time data to provide comparison, insights, and confidence in forecasting.

The integrated project and portfolio space makes this possible and allows users to compare snapshots and forecasts at any point in time - for example, looking ahead 12 months or comparing historic forecasts against actuals.

The Portfolio Snapshot functionality gives Portfolio and Finance Managers confidence in their projections at a glance, using different colours to highlight funded and unfunded forecast numbers, and listing all the projects impacting variance.

Accurate cashflow forecasting through data integrity

This ability to draw a line in the sand and remove the guesswork was the impetus behind creating the Portfolio Snapshotting functionality. With countless data points across multiple projects (and various currencies in some instances), it creates a fully-formed picture. And this information becomes the baseline for accurate forecasting.

Most organisations strive for constant spend throughout the year. It’s predictable and manageable with a fixed resource base. But when underspend early in the year requires increased spend in the second half, the dreaded hockey stick spending begins to form. The devil is in the detail.

Being able to visualise and understand exactly why and how a project portfolio is progressing, and whether projected project outcomes are still reasonable, is infinitely valuable.

Seeing the breakdown between funded ongoing projects and unfunded future projects in a simple chart, at the same time, gives a level of trust in financial projections (or lack of). Now that you can view multiple comparisons, it allows you to predict potential outcomes and iterate for greater success.

The bottom-up view of spending through project portfolio analysis provides several additional benefits to support Portfolio Managers and Finance Teams:

- Informs decisions to reallocate budget across your organisation depending on the performance of individual business units.

- Automated calculation of monthly indicators

- Quick identification of the projects with the greatest variance to show impact on the project portfolio, as well as the ability to drill down into a more detailed assessment.

- Financial data overlayed with project historical data to provide context around progress, spending, and forecasting confidence.

Ultimately, no organisation can see into the future and retrofit decisions to optimise their commercial outcomes. But an organisation that has a clear picture of its current portfolio state, and can compare varied forecasts for better resource management, has the competitive advantage to make data-driven decisions that maximise capital investments.

For further information about the CAPEXinsights Portfolio Snapshot tool or to have a personalised demonstration of our product, please don’t hesitate to reach out to us.